In accounting, there are specific rules for reporting costs and profits. In economics, it’s more about the general theories around profit and costs to help companies grow. Both are critically important, but they serve a different purpose. Understanding the difference between accounting profit vs economic profit is a key part of understanding how businesses work. There is a lot of information out there about business profits and costs. Unfortunately, much of it is not clear or direct. Even though we’ll be digging into some pretty dense stuff with heavy math, we promise you won’t get lost in the weeds! Let’s break it down so you can understand the difference between accounting and economic profit!

What is Accounting Profit?

It is the amount of money that appears on your company’s Income Statement at the end of the fiscal year. It is based on the prices of goods sold and the costs of producing goods. The formula for accounting profit is Revenue – Costs = Accounting Profit. It is usually shown as a percentage of revenue since it is a ratio. This is useful when comparing profits across different companies and industries.

Accounting profit is the amount of money you are required to report to your shareholders and the government. Since this profit is based on the prices and costs of goods sold, it is important to understand accounting conventions. Accounting conventions determine which costs get reported and how they are reported. Accounting conventions can change depending on the type of company and industry. Accounting profit is the starting point for calculating economic profit.

What is Economic Profit?

Economic profit is the difference between Total Revenue and Total Costs. It represents the amount of money that is left over after all costs are accounted for.

It can also be thought of as profit leftover after all expenses, losses, and debts have been paid. The formula for economic profit is Total Revenue – Total Costs = Economic Profit. Economic profit is an important indicator of how well a company is performing. It is sometimes used to compare companies within an industry, but it is not common to compare companies across industries.

Economic profit is a theoretical concept used to understand how a company’s decisions impact their success. Economic profit can be calculated using accounting profit, but it can also be calculated based on the opportunity cost of capital. Opportunity cost accounts for the money that could have been made if it was in a different investment.

The Difference Between Accounting and Economic Profit

The main difference between accounting and economic profit is that this profit is based on the costs and prices of goods sold while economic profit is based on total revenue and total costs. This profit is reported on a company’s income statement.

It is used to calculate taxes and other financial ratios. Economic profit is not reported anywhere. It is used to understand the health of a company and to make business decisions. Economic profit can be calculated from accounting profit, but accounting profit cannot be calculated from economic profit. Accounting profit does not factor in opportunity costs or the time value of money.

When Is Accounting Profit The Same As Economic Profit?

Accounting profit is the same as economic profit when there are no costs or expenses. This will never happen in real life, but it is a useful way to understand the difference between accounting and economic profit. When there are no costs and expenses, the accounting profit will be the same as the economic profit. The formula for calculating economic profit when there are no costs and expenses is Total Revenue – 0 = Total Revenue.

When Is Accounting Profit Not the Same as Economic Profit?

Accounting profit is not the same as economic profit when there are costs. This also happens to be the most common scenario. Accounting profit does not factor in opportunity costs or the time value of money. Economic profit takes into account opportunity costs and the time value of money. When you make a purchase, the money you spend is not available to be invested. It is lost because you cannot use it at that moment. This is an opportunity cost.

For example, let’s say you purchase a computer for $2,000 and rent office space for $1,000 per month. Accounting profit will be $3,000 ($2,000 + $1,000). Economic profit will be $1,800 ($3,000 – $2,000 + $1,000).

Economic vs. Accounting Return on Investment

Accounting ROI is based on the costs of a company’s assets. It is calculated as the amount of money an asset cost divided by the amount of money the asset makes. Economic ROI is based on the total profit left over after all costs have been subtracted from total revenue. It is calculated as the amount of money that is left over after all costs have been subtracted from total revenue.

Differences in Net Income and Cash Flows

The main difference between Net Income and Cash Flows is the time frame. Net Income is reported on the Income Statement at the end of the fiscal year. Cash Flows are reported on the Cash Flow Statement at the end of each month. Analysts, investors, and management use Cash Flows to monitor the health of a company. They also use it to determine how much to charge for goods and services. They use Net Income to determine how much to pay in taxes.

How to Find Economic Profit

To find economic profit, you need to know the total revenue, total costs, and opportunity costs of the company. You will calculate economic profit by subtracting total costs from total revenue. If you are using accounting profit, you will need to adjust your numbers to account for opportunity costs.

You can do this by adding the opportunity cost of capital to the total cost. To calculate economic profit based on accounting profit, you will need to make a few adjustments. You will need to add the opportunity cost of capital to the cost of goods sold and the cost of any operating expenses. You will also need to subtract out the amount of taxes paid.

Summing up

Accounting profit is based on the costs and prices of goods sold. Economic profit is based on total revenue and total costs. Accounting profit is reported on the income statement for a company. It is also used to calculate taxes. Economic profit is not reported anywhere. It is used to understand the health of a company and make business decisions.

To understand the difference between accounting and economic profit, it is important to understand the concept of opportunity cost. Accounting profit does not factor in opportunity costs, but economic profit does. Accounting profit is based on the prices and costs of goods sold, while economic profit is based on total revenue and total costs.

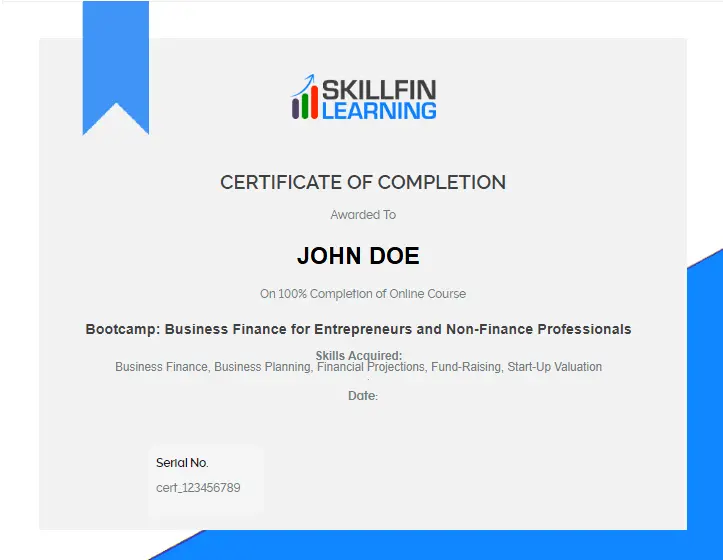

Related Courses: Start-Up Planning, Forecasting and Valuation Courses

3 thoughts on “Clarifying the Difference between Accounting Profit and Economic Profit”

[…] Companies, having same operating profits may have different TSR because of leverage. The one with leverage will generate a higher TSR. […]

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.

Thanks so much for the blog post.Much thanks again. Really Great.