Have you considered starting a start-up?

There is a start-up boom in Israel, India, the United States, Canada, Sweden and many other countries in the world. Start-ups create tens of millions of jobs for young people, and lower some of the pressure on some of the larger corporations.

Some of the start-ups that you see around you will go on to make massive successes, like AirBnB, Uber and Dropbox, while others will fail to take off and shut down. That should not be an issue, because there are many start-up entrepreneurs who fail in their first, second and even third attempts, but achieve tremendous wealth and success with the next venture.

However, starting a start-up is not easy.

The biggest challenge an entrepreneur has to deal with has to do with fundraising for a start-up. It is particularly challenging in the current funding winter environment when there is a general slowdown with VC funding in the overall market. Also it has been seen that traditional banks are also not so willing to lend to new businesses or startups given there is a lack of proven business model for these companies.

Fund raising is critical to a start-up’s success

If you fail to get the necessary funding for your new business, then you will have a serious problem holding on to your employees, paying for the hardware and software licenses, keeping vendors and suppliers happy and even paying the rent.

Here’s a Look at the Typical Challenges related to Fund Raising For Start-Ups…

#1: Attracting Early Stage Investors

It is very difficult to get pre-seed investors or early stage investors for your start-up outside of your family and friends. You must have at least some sort of track record to get investors to even have a look at your business. Just having a great idea won’t do much for you as far as raising funds is concerned.

#2: Finding the Right Investor

It is very, very difficult to find the right investor and get them to commit to your startup. Investors have different preferences and may not see things the way you do. They have a certain level of risk tolerance, investment timelines that they have to adhere to and other restrictions. Getting the right investor who is excited by your idea and has full faith in you is very difficult.

#3: Delivering the perfect pitch.

The pitch or how you introduce your startup to potential investors makes all the difference. It’s so easy to get disheartened when the VC or angel investor doesn’t look all that impressed by your pitch.

They may find gaps in your customer analysis and flaws in some of your projections and assumptions. The problem is you have never developed a funding strategy.

Which is why…

Even if your start-up has nothing to do with finance, you should consider joining our certification program on Business Finance for Startup Entrepreneurs and Business Founders. In this course, you will learn how to create financial models for capital raising, business valuation and business planning. At the end of this course, you will be able to deliver the perfect pitch and know exactly how to handle the investor negotiations.

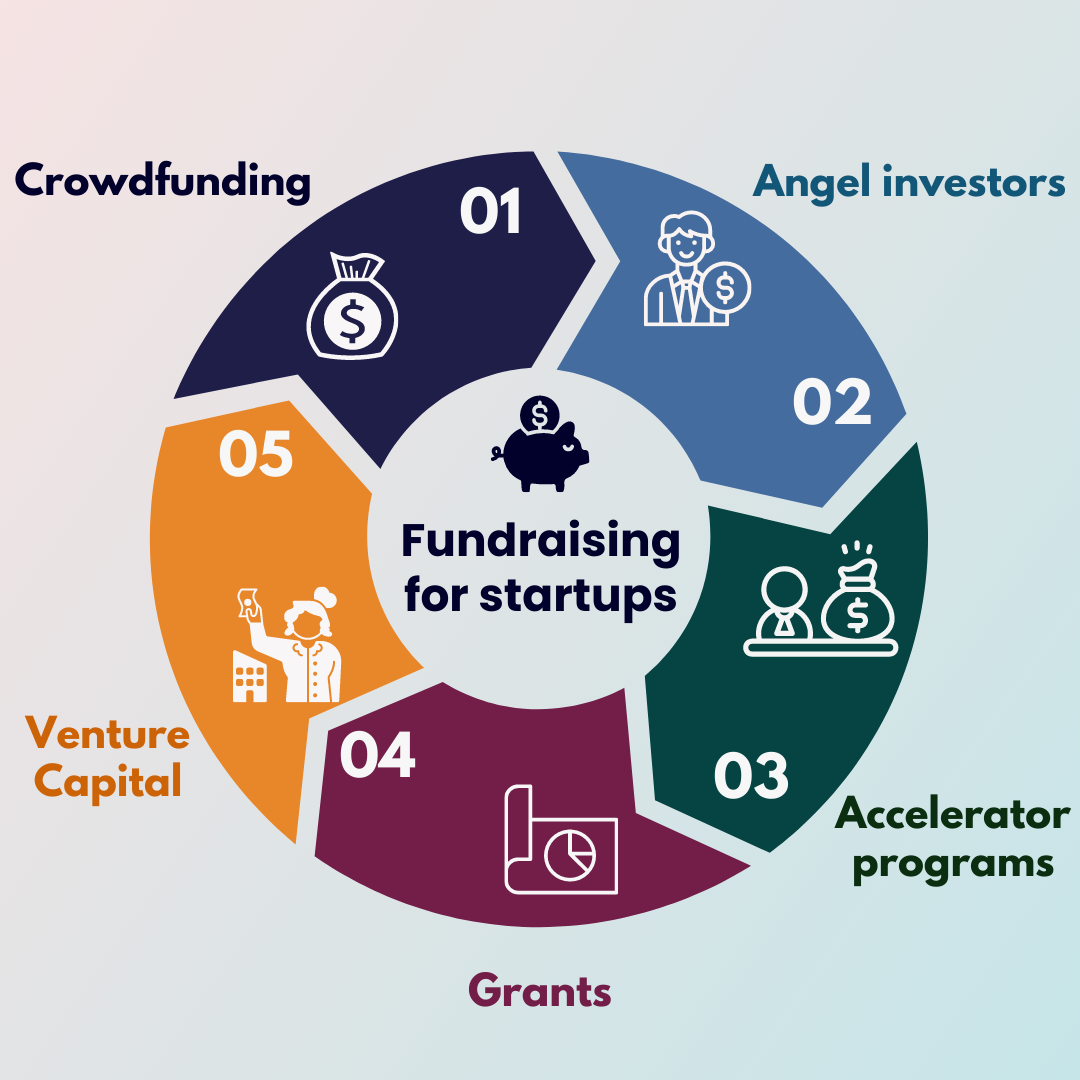

Potential sources for fund raising:

One, Angel investors – These are typically high net worth individuals who potential have huge personal wealth which they are interested in deploying in new age companies. The typical check size varies a lot here but can range from $1000 to even $100,000. As you can see this is like really the first funding that a company seeks so you would expect the funding to be small to prove some success with your idea.

Two, Accelerators – There is also now an emergence of accelerator funds who initially started off with helping start-ups with their business plan and go to market strategy and help in fund raise as well. However, some of these accelerators are also now looking to fund early stage companies. For example, take a look at Y Combinator (YC). As per YC website,

“YC invests $500,000 in every company on standard terms. Our $500K investment is made on 2 separate safes:

- We invest $125,000 on a post-money safe in return for 7% of your company (the “$125k safe”)

- We invest $375,000 on an uncapped safe with a Most Favored Nation (“MFN”) provision (the “MFN safe”)”

And Three, Venture Capitalists –

Venture Capitalists are typically the large institutional investors who could put in a check in excess of $ 100,000 to anywhere up to $10-20 mn. Typically, you would raise series A and onward funding through venture capitalist. They are serious investors who are willing to bet big on your company and therefore the scrutiny that you will need to go through will be very high.

Depending on the stage of your company, these 3 potential fund raising sources can come in handy to you.

5 thoughts on “Fund Raising for Startups: What Are the Typical Challenges?”

… [Trackback]

[…] There you will find 20256 more Infos: skillfine.com/fund-raising-for-startups/ […]

… [Trackback]

[…] Read More on that Topic: skillfine.com/fund-raising-for-startups/ […]

… [Trackback]

[…] Here you can find 80415 additional Information on that Topic: skillfine.com/fund-raising-for-startups/ […]

I’ll right away snatch your rss feed as I can’t in finding your e-mail subscription link or e-newsletter service. Do you’ve any? Kindly allow me realize so that I may subscribe. Thanks.

Your article helped me a lot, is there any more related content? Thanks!